Tax Savings in '07 - Modest Gains for Individuals, Families with Young Children Win Big

Ottawa: The Canadian Taxpayers Federation (CTF) today released projected income and payroll tax changes kicking in on January 1st, 2007.

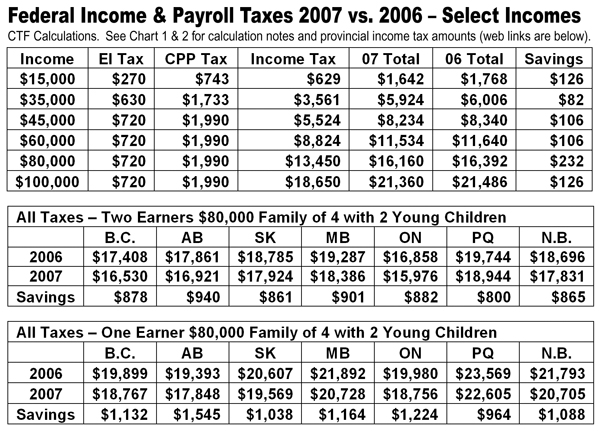

"All taxpayers will pay less tax in the New Year," said CTF federal director John Williamson. "The new employment tax credit will increase to $1,000 for the 2007 tax year, up from $250 in 2006. This fourfold increase permits the finance minister to truthfully assert taxes are going down even though Canadians will pay more payroll taxes next year and the lowest personal income tax rate will rise a quarter-point to 15.5% from 15.25%."

News Editors: It has been reported the value of the employment tax credit - unveiled in the 2006 budget - is $500 for the 2006 tax year. This is wrong. Please refer to the Canada Employment Credit, page 219, Annex 3 of The Budget Plan 2006. CTF calculations, which are prepared annually, include the new $1,200 (pre-tax) Universal Child Care Benefit for consistency as tax figures also incorporate the Canada Child Tax Benefit. These calculations do not measure the one-point GST reduction, the effect of pension splitting or the impact from tax credits that benefit some, but not all taxpayers.

"Without a doubt the biggest winners are families with young children. They will rocket ahead thanks mostly to the monthly $100 payment for each child under age 6," stated Mr. Williamson.

Provincial Income Tax Changes

The pdf Tax Savings chart details overall federal-provincial tax savings province by province for various income scenarios.

"Low-income individuals, earning less than $25,000 annually, benefit the most from Ottawa's new employment tax credit. Also noteworthy are that the larger tax savings for individuals earning $80,000 is due to indexation and how unevenly families with similar income levels are taxed," said Williamson. "One the provincial front, Manitoba taxpayers will realize the largest savings due to a drop in its middle income tax rate."

Payroll Taxes Continue to Increase

Effective January 1st, 2007, Employment Insurance (EI) premium rates will drop by seven cents to $1.80 for employees (per $100 of insurable earnings) from the current rate of $1.87. The corresponding employer rate will drop by 10 cents to $2.52 from the current rate of $2.62. However, the maximum insurable earnings will rise from $39,000 to $40,000. The previous EI threshold increase was in 1995. The seesaw EI changes represent a mere 1.3% reduction from 2006 levels.

Canada Pension Plan (CPP) premium rates (per $100 of insurable earnings) will remain unchanged at 4.95% paid by employees and 4.95% paid by employers. The threshold will increase to $43,700 in 2007 from today's $42,100 level. See pdf Payroll Tax chart and graph for 2007 and historical EI and CPP tax changes.

"The net payroll tax bill on workers will increase because the EI tax reductions will be gobbled up by a higher EI threshold and rising CPP payments. Workers will pay $70 more in payroll taxes and employers $65 more," said Williamson. "Ottawa was wrong to increase the EI threshold when the program continues to amass an annual $2-billion surplus. It is another example of giving a tax break with one hand, by lowering the EI tax rate, and taking it away with the other, by raising the threshold."

A Tax Cut Plan for All Canadians

The CTF proposes to increase both the basic personal and spousal exemptions to $15,000 over four years. This will save taxpayers $940 a year. In addition, the top two personal income tax rates should be reduced by 3% - phased-in over three years - from 29%-to-26% and 26%-to-23%.

"It is not sufficient for parliamentarians to only discuss cutting taxes for low- and modest-income Canadians," concluded Williamson. "According to the OECD and even Canada's finance department, our personal income tax burden remains the highest of the G-7 nations. This standing has not changed in almost a decade. Broadly-based tax relief in the '07 budget is necessary to ensure all income earners benefit from lower taxes."